kern county property tax payment

In addition to the forms listed below more forms related to Changes in. Kerr County Tax Office Phone.

Kern County Treasurer And Tax Collector

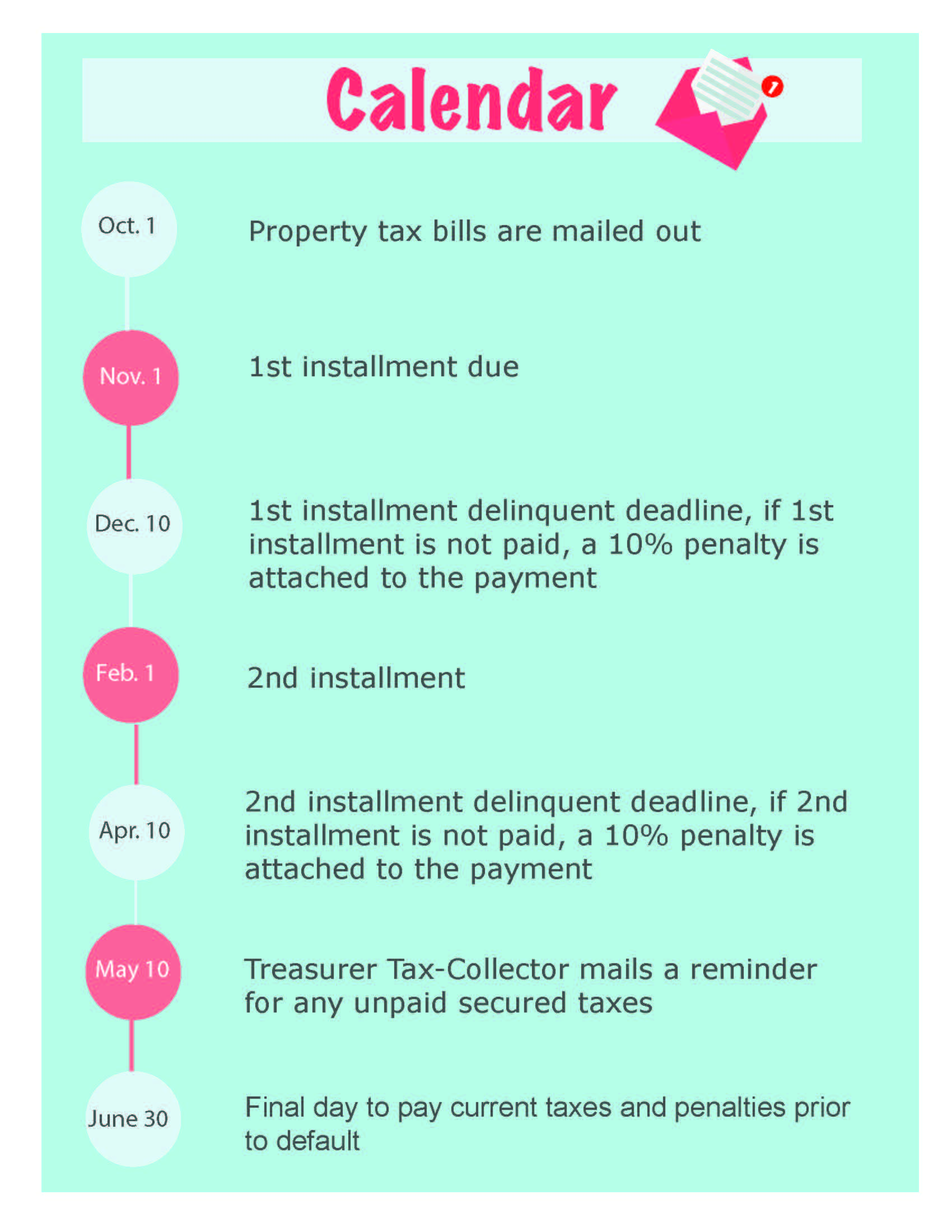

Secured tax bills are paid in two installments.

. Kern County Treasurer-Tax Collector mails out original secured property tax bills in October every year. If the bank pays your taxes you will receive an informational bill from this office by January 31st. How to Use the Property Search.

If the bank pays. Start by looking up your property or refer to your tax statement. The median property tax also known as real estate tax in Kern County is 174600 per year based on a median home value of 21710000 and a median effective property tax rate of.

Taxation of real property must. Riverside County homeowners pay a median annual property tax payment of 3144. Senate Bill 813 enacted on July 1 1983 amended the California Revenue and Taxation Code to create what are known as Supplemental.

The majority of Assessor forms are developed and provided by the California State Board of Equalization. In Kern County California a home worth 217100 pays a median property tax of 1746 per year. Kern County Property Taxes can be paid online by mail or in person.

This means that residents can expect to pay about 1746. Property Taxes - Assistance Programs. The first installment is due on 1st.

Please select your browser below to view instructions. Supplemental Assessments Supplemental Tax Bills. In Kern County the average property tax rate is 08 making property taxes slightly higher than the state average.

Enter a 10 or 11 digit ATN number with or without the dashes. Kern County Treasurer-Tax Collector mails out original secured property tax bills in. Cookies need to be enabled to alert you of status changes on this website.

The Kern County Treasurer Tax Collectors Office is located at 1115 Truxtun Avenue Bakersfield CA. Residents of Kern County pay an average of approximately 283 of their. Enter an 8 or 9 digit APN number with or without the dashes.

Please enable cookies for this site. Property Taxes - Pay Online. Look up your property here 2.

1 be equal and uniform 2 be based on current market worth 3 have one estimated value and 4 be considered taxable if its not specially exempted. Request Copy of Assessment Roll. Kern County is ranked 709th of the 3143 counties for property taxes as a.

Property Tax Portal Kern County Ca

Kern County Ca Property Tax Search And Records Propertyshark

Tax Breaks Allow Kern S Solar Industry To Pay Far Less Property Tax Than Oil Ag And Wind Kbak

Sherburne County Moves To Abate Penalties For Late Property Tax Payment Kstp Com Eyewitness News

Jordan Kaufman Kern County Treasurer Tax Collector

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

First Installment Of Real Property Taxes Due Dec 10 News Bakersfield Com

Kern County Treasurer And Tax Collector

The Property Tax Deadline Of Greater Bakersfield Chamber Facebook

Assessor Parcels Land 2022 Kern County Gis Open Data Geodat

Kern County Treasurer And Tax Collector

Equipmentfacts Com Real Estate Property Kern County Ca Online Auctions

Kern County California Fha Va And Usda Loan Information

Kern Co Weighs Levying 1 Cent Sales Tax On Unincorporated Communities

Kern County Treasurer And Tax Collector

Jordan Kaufman Kern County Treasurer Tax Collector

Ca Kern County Quitclaim Deed Complete Legal Document Online

Kern County Ca 2021 Tax Sale Over 1 500 Properties Deal Of The Week Youtube